Minimum Loan Requirements

We help you save time with our simplified business loan documentation for all your business needs. We offer a hassle-free with minimum documentation & quick turnaround time.

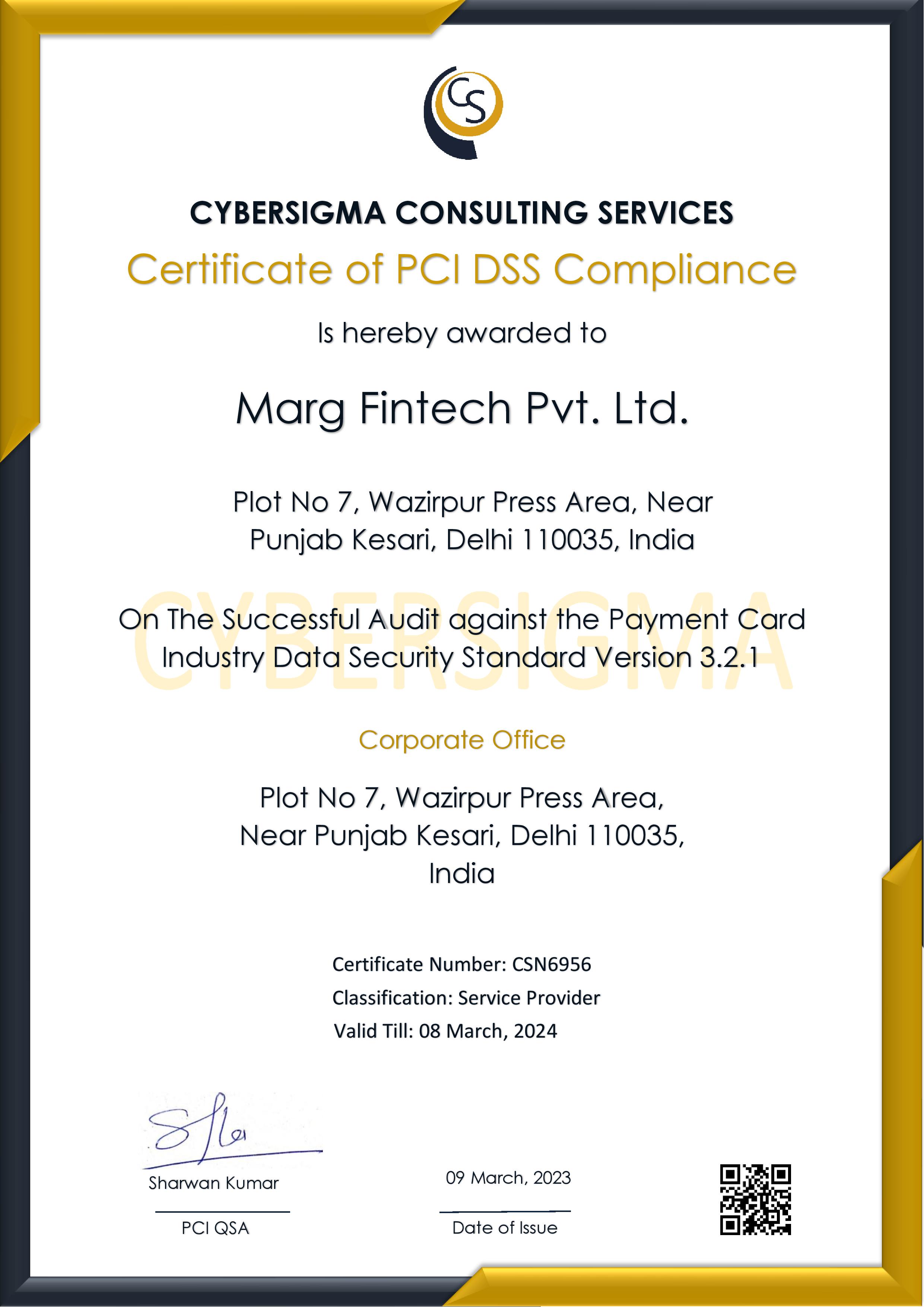

Get your loan in three simple steps

From planning a renovation to facing an unexpected expense, we have a solution to your planned/ unplanned expenditures. Simply apply for a business loan online from the comfort of your office or home and get a seamless loan disbursal experience.

Register & Verify

Fill your details online & verify your mobile number via OTP

Share Your Documents

Once your eligibility is confirmed. Provide the required documents to our executive

Get Loan

After verification & approval, get your funds to grow your business

Types of Loan we offer

Making our business loans more affordable & convenient we offer simplified online process to get quality service & instant approval on business loans for SMEs & MSMEs

Unsecured Business Loan

Easy installment term loans for shop renovation, business expansion and other one-time business needs

Upto 50 lakh loan with easy installments (upto 36 months tenure) starting @ 1.35% per month reducing balance

Bill Payment Loan for retailers

Real time and easy working capital facility (upto 50 lakhs) for retailers

Low interest rates starting @ 0.05% per day

Interest to be charged only on utilized amount

Documents Required to Get Your Loan

We help you save time with our simplified business loan documentation for all your business needs. We offer a hassle-free with minimum documentation & quick turnaround time.

Personal KYC

Business KYC

Bank Statements/Financials

Why choose MargPay “NBFC Partners” loan

Marg Indifi Loans was built with one mission to provide financial support to medium & small businesses. Under Marg network we're already serving 10 million users & helping them grow digitally. Manage your immediate business needs with our finances.

Save 4-6 weeks of stress in just 3 simple steps.

Get hassle-free business loan from India's most trusted B2B payment platform

Where you can use it?

Our loan is designed to facilitate small & medium businesses and cater their financial requirements for business developments. The business loans can be used for

Inventory Purchase

Purchase inventory, stock, raw materials etc to boost up the cash flow of your business.

Marketing Activities

Invest in innovative marketing ideas, advertisements, events etc. to heighten your profits

Renovation store/ shop

Increase manpower, initiate new franchise, infrastructural development, etc. to expand your business